Consumers of United States, give yourselves a pat on the back. According to FICO, the average credit score has reached 700, the highest average since the recession in 2006. This means that on average, consumers in United States have seen an overall increase to their credit score.

If your credit score has not seen positive change, do not fret. There are habits you can make or change that will help you raise your credit score. But first, let’s take a look at the changes in consumer essay writers credit score in the recent years.

Recent History of Consumer Credit Score and Its Implications

There have been many changes in consumer credit score over the past years. By looking at the changes, we are able to make some assumptions about consumer behaviors.

Fewer Lower Scores and More Higher Scores

In general, there have been fewer consumers who had lower scores and more who had higher scores. This is good news, and it may indicate that more consumers are being responsible for their credit. With the Internet being more accessible, more people are able to find advice that will help with their credit situation.

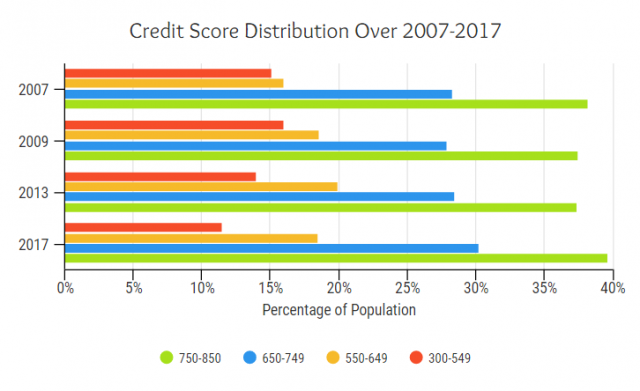

Here are the average credit score changes from 2007 to 2017:

From this graph, consumers with…

- Bad credit rating (300-549) have decreased by 3.6%.

- Poor credit rating (550-649) have increased by 2.5%.

- Good/Fair credit rating (650-750) have increased by 2.0%.

- Excellent credit rating (750-850) have increased 1.5%.

It may seem bad that consumers with poor credit rating have increased, but the increase could have resulted from consumers moving out of the bad credit range into the poor rating. So, technically, this increase can be seen as a good sign.

Overall, the general trend of credit rating seems to be moving in a positive direction.

Behavior Changes You Can Make To Increase Your Credit Rating

A big part of why someone might have a poor credit score is because of their lifestyle. They might not have their priorities straight and spend their money on materialistic goods instead of saving it to pay their bills. Following these lifestyle changes may help you increase your credit score.

Pay Your Bills On Time

The key to reaching a perfect credit score involves paying your bills on time. Having delinquency on your credit report can lead to a big drop on your credit score, especially for those with higher credit scores. Fortunately, consumers with serious delinquencies of more than 90 days have been decreasing over the past 2 years.

If you wish to keep your credit rating from dropping, make sure you are able to pay your bills on time. Creating a budget might help!

Check Your Credit Report For Errors

Another change in behavior is checking your credit report to make sure there are no inaccurate information on it. Errors on your credit report can misrepresent you and can lead to a drop to your credit score.

For example, if you have a common name, the credit reporting agencies might report you as someone else with the same name. If the person with the same name has a long case of criminal record, it may reflect poorly on you even though you are not that person.

Take Care of Your Credit Score

You’ve now read and learned about some ways to keep your credit score in check. With these tips in mind, we hope that you are now better equipped to increase your credit score. With proper budgets and keeping your credit report free of errors, you will be able to raise your credit score.